Low liquidity is a temporary situation, but government debt is not.

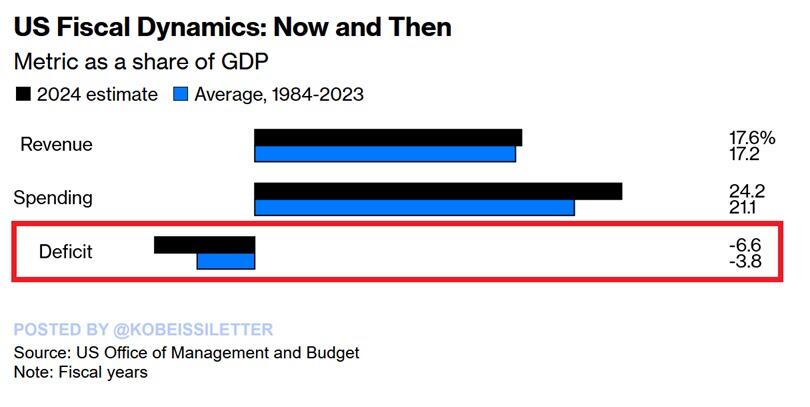

The emergence of an economic structure based on debt issuance has allowed governments around the world to expand their public spending.

More spending provides more arguments for what they can claim to have accomplished during their terms.

This has created a structural need for greater state intervention in services and infrastructure.

With higher public spending comes a larger government deficit (expenses minus revenue from taxes), leading to more debt issuance to cover the lack of capital.

However, this debt issuance becomes unpayable when more spending is generated (which happens with every new populist government).

The government discovered that it could buy its own debt by issuing new monetary units and reducing the interest on that debt.

However, it does so by stealing the current purchasing power of the population to gain a short-term advantage.

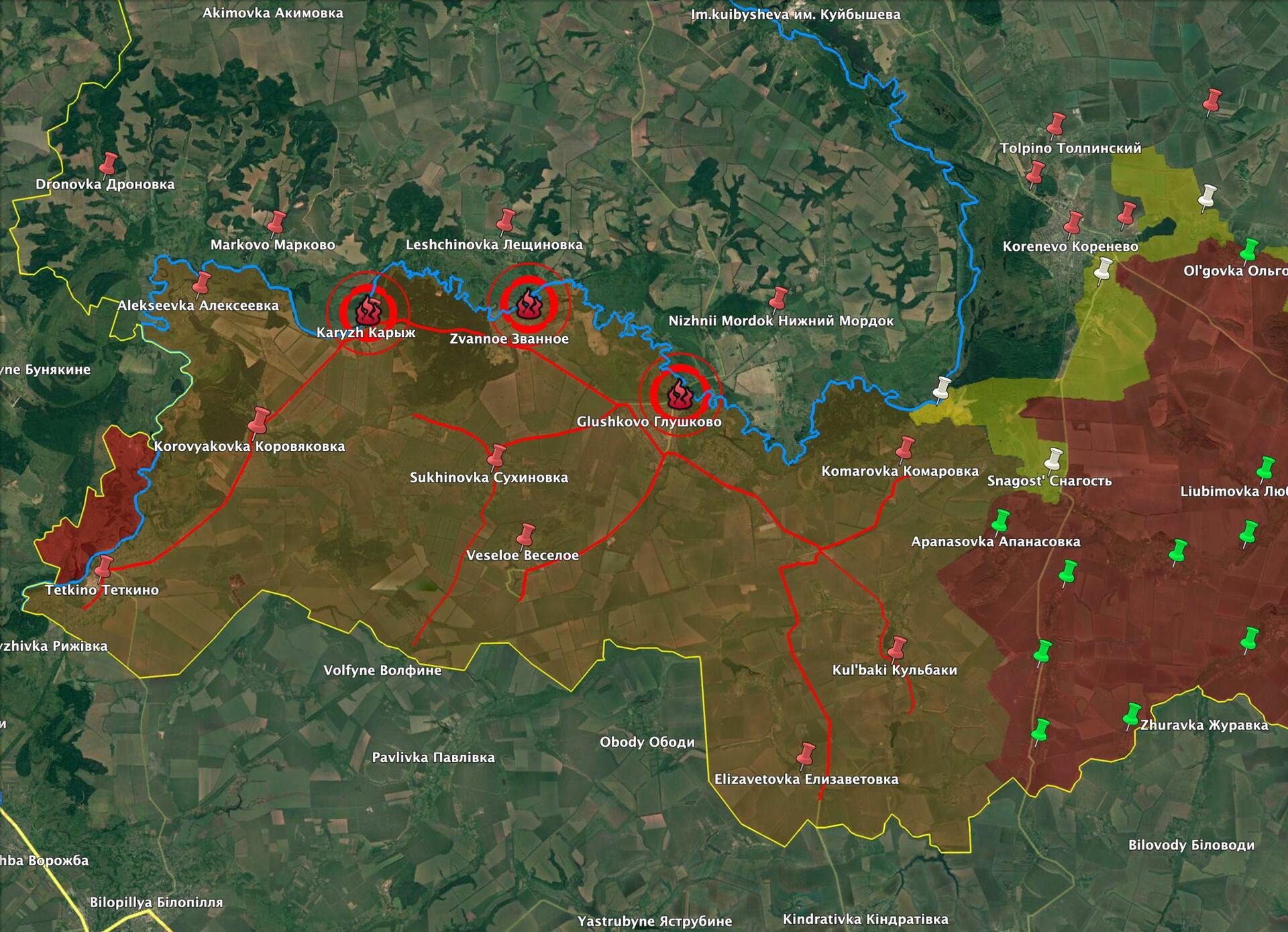

Currently, the liquidity structure is low, with the sea of monetary issuance quite calm.

But don’t be fooled—new waves are coming soon. Debt issuance is already reaching unsustainable levels in several countries, and economies like the U.S. are close to needing new capital injections.

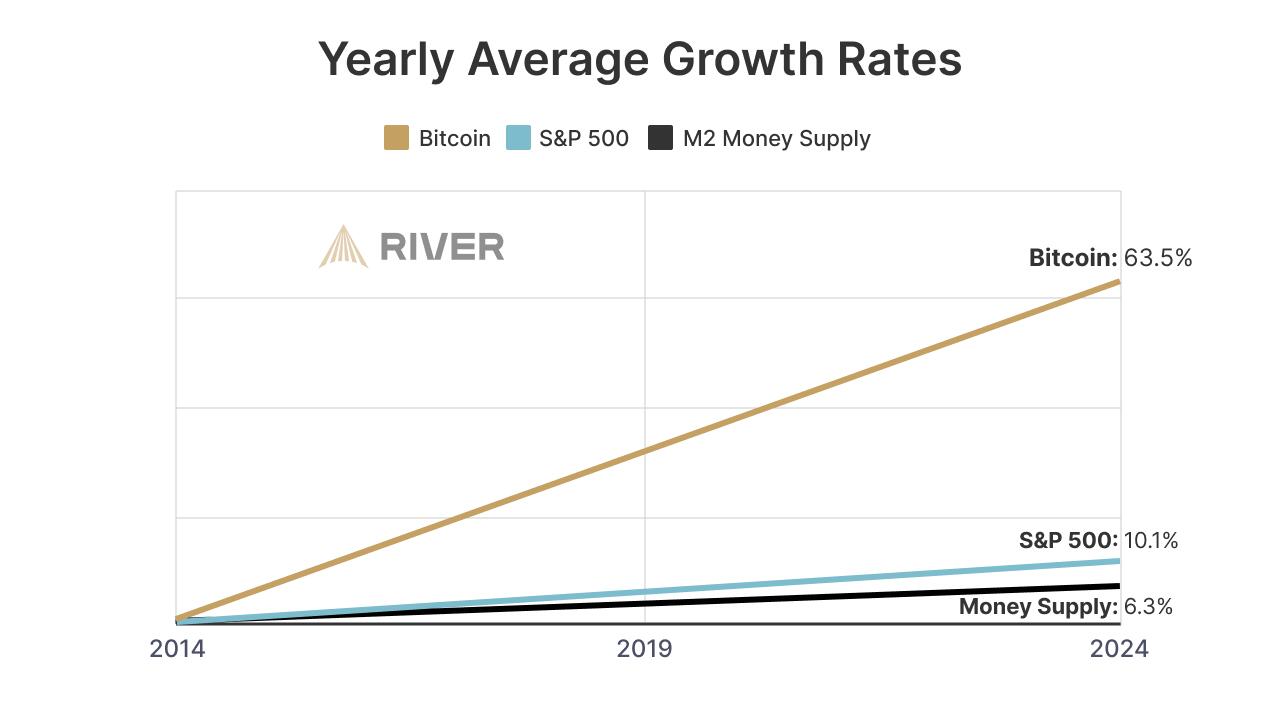

On the other hand, Bitcoin's price remains weak, mainly due to this calm sea of liquidity.

As soon as new waves (or tsunamis) of liquidity arrive, one of the first assets to benefit will be Bitcoin.

That’s why it’s essential to understand that navigating calm seas is easier. Accumulating during periods of low volatility and a downward trend is better for those with a long-term vision.

Have a long-term vision.

And study #Bitcoin.