How MicroStrategy is creating infinite money using Bitcoin 💰

Michael Saylor, founder of MicroStrategy, has literally discovered a "glitch" in the financial market and is using Bitcoin to create infinite dollars.

This might be the first of many speculative attacks against the dollar that will emerge in the coming years—using BTC.

Michael Saylor is definitely a guy who knows what he's talking about.

About 12 years ago, he was already saying that Apple could become one of the biggest companies on the planet—since then, it has grown 10x and is now in the top 2, neck and neck with Microsoft.

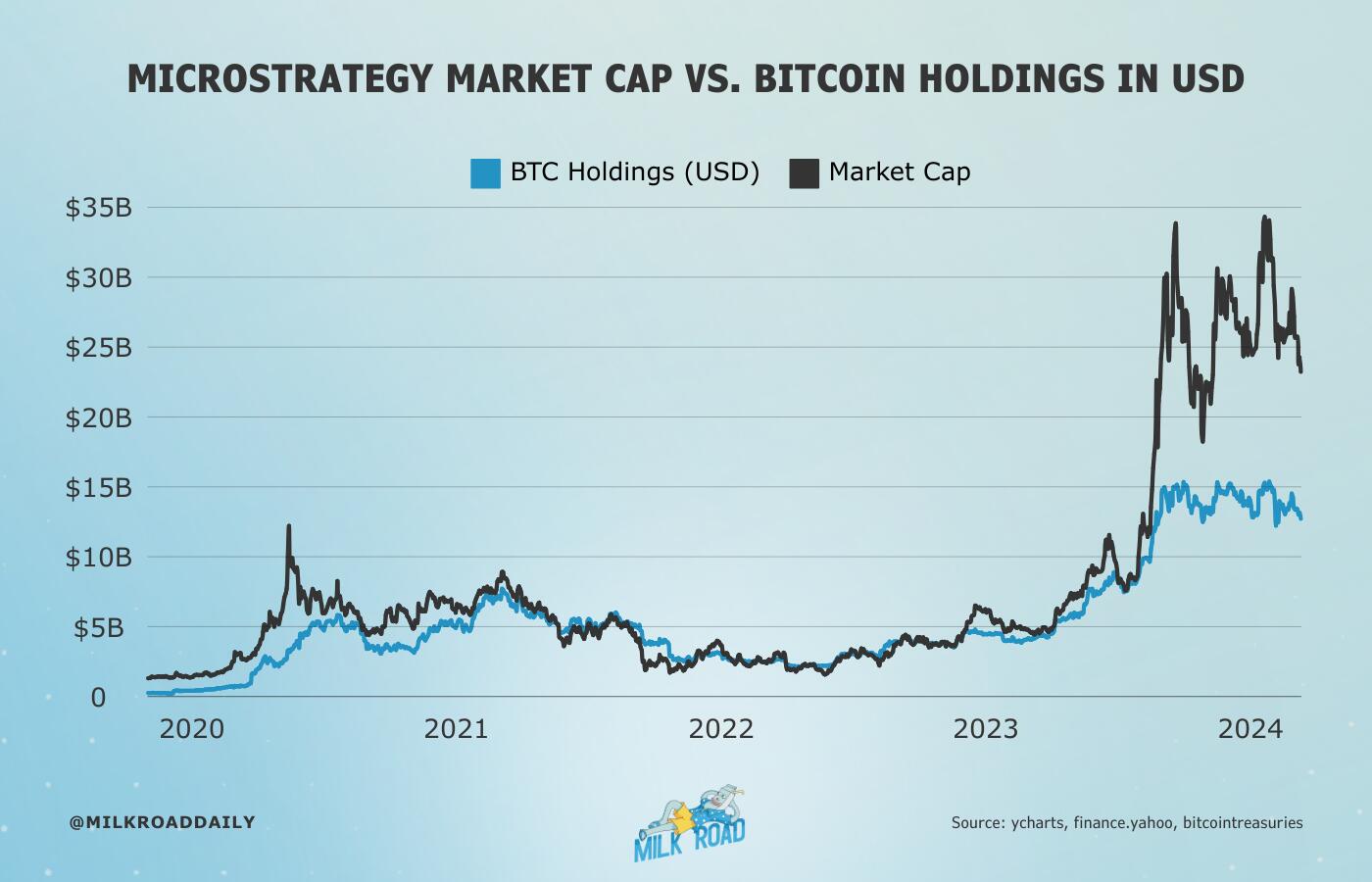

And since MicroStrategy ($MSTR) began implementing its strategy of buying as much Bitcoin as possible in 2020, its market capitalization has increased 20 times, accumulating around 244,800 bitcoins. 🤯

When you have a publicly traded company—like MSTR—there are several financial mechanisms you can use to borrow money at extremely low interest rates.

This is something most billionaires already do (mainly to avoid paying taxes).

Usually, you leave some of your shares as collateral, and you get a low-interest loan to spend freely, rolling that debt indefinitely.

Another mechanism companies use is issuing new shares, mainly to increase liquidity in the market, raise cash, and reduce their debt.

What happens when you combine these two things with Bitcoin?

Basically, infinite money!

Michael Saylor is issuing convertible notes (which are loans that can be converted into discounted MSTR shares in the future) to buy Bitcoin.

This would theoretically dilute the company’s stock price, but here’s the clever part.

He issues debt > buys Bitcoin > Bitcoin appreciates > MSTR rises along with it > he issues more debt… and so it goes.

Now, Saylor is once again preparing to sell $1.1 billion in convertible notes to continue accumulating even more BTC.

Currently, the company holds $3.9 billion in debt, but the profit from this operation is already more than double that, and with each halving, this gap will widen further.

Plus, keep in mind that MicroStrategy is still a solid cash-generating company, meaning they can easily service these loans.

You’ve got to admit, the guy has quite the brain, right?

Not only has the company profited immensely from this strategy, but so have its investors.

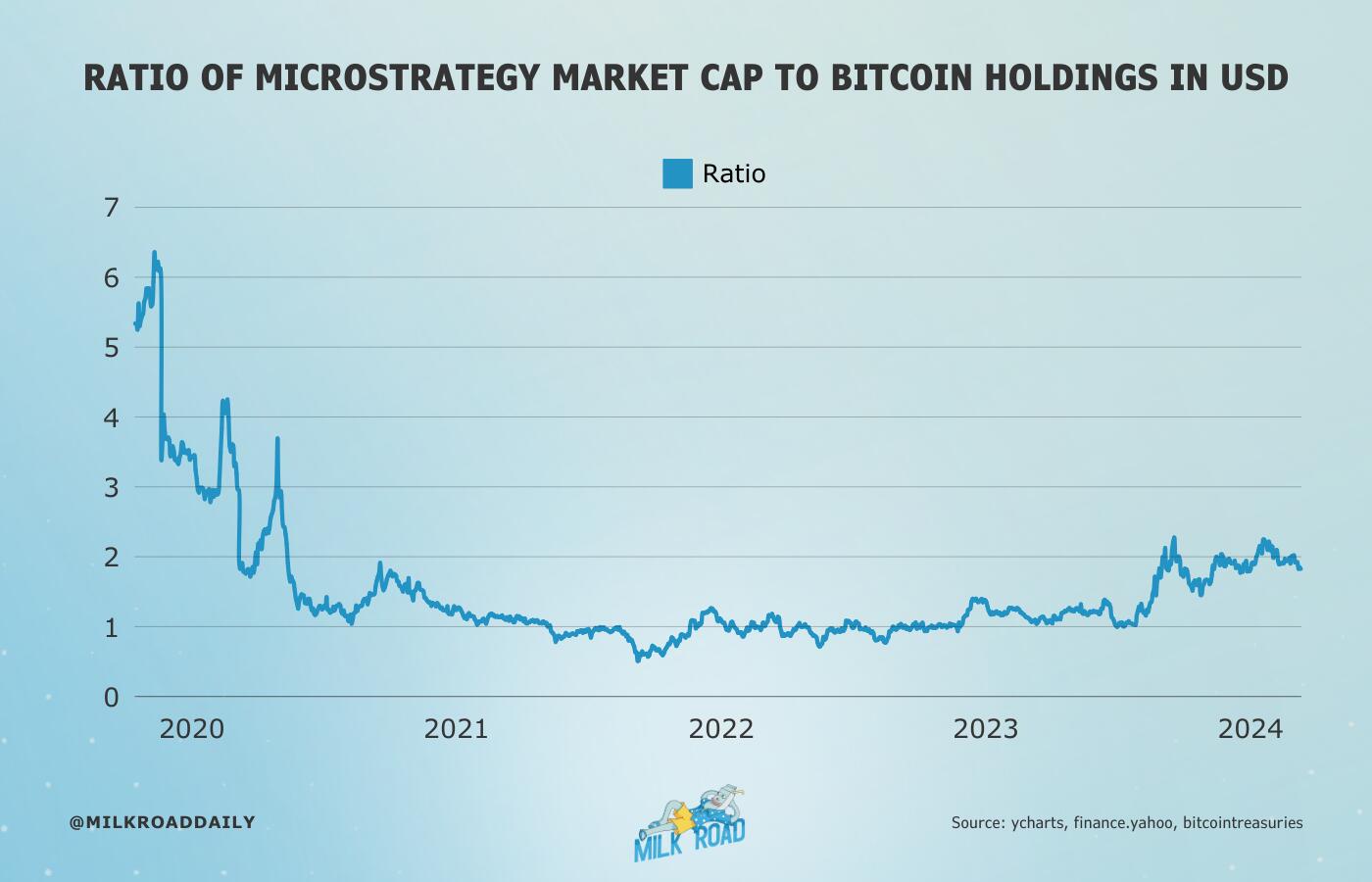

Since MSTR never sells its Bitcoin, during a bear market, MicroStrategy's value remains almost identical to the value of its BTC holdings.

Meanwhile, in a bull market, the company’s value is assessed at a premium relative to its Bitcoin holdings. 👇

To the point that, in the current market, when MicroStrategy buys $1 billion in BTC, its market capitalization eventually rises by $2 billion over time.

How long will this correlation last? That's a good question.

The fact is that this strategy is simply brilliant!