If you’re not prepared to handle volatility, don’t mistake it for Bitcoin’s inability to preserve value.

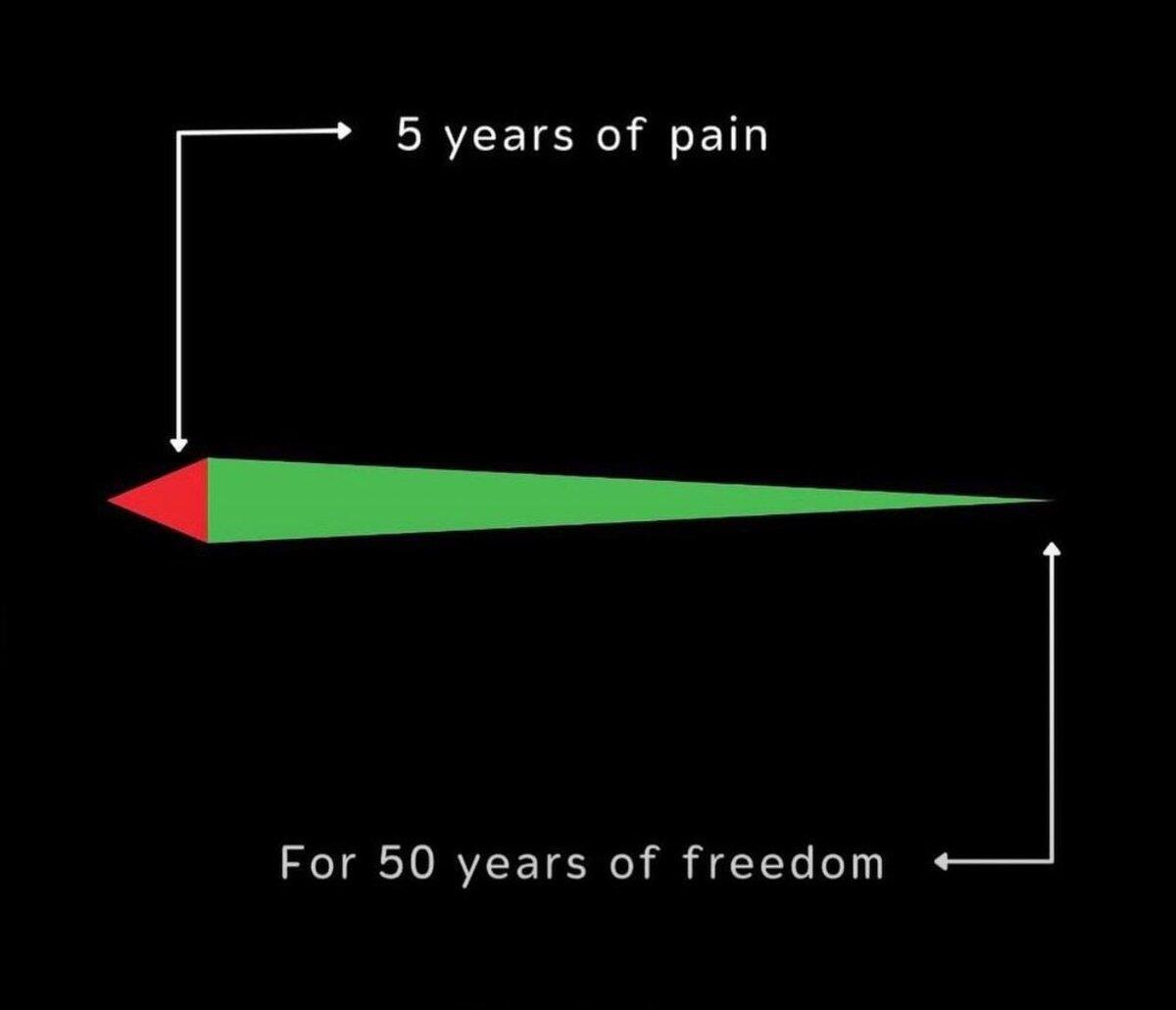

Bitcoin is about low time preference. If short-term price swings still scare you, it’s a sign that you need to deepen your understanding of Bitcoin’s purpose.

In the short term, the market is random and full of noise. The more you reduce your time preference, the easier it will be to navigate periods of high volatility.

An asset with a CAGR above 100% over the past 10 years can only sustain such growth through volatility. This isn’t a bug; it’s a feature.

The market is indifferent: it doesn’t care if you’re experienced or a beginner. If your emotions drive your decisions, your liquidity will be taken.

The real gains don’t come from buying and selling constantly but from waiting.

Many people entering the market now will lose money, even with Bitcoin ending the year up over 130%.

The key to avoiding this is to worry less about short-term movements and focus more on the market cycle structure and Bitcoin’s incredible ability to absorb capital.

Talk to anyone who’s been holding Bitcoin for over three years. The concept is simple, but no one said it would be easy.