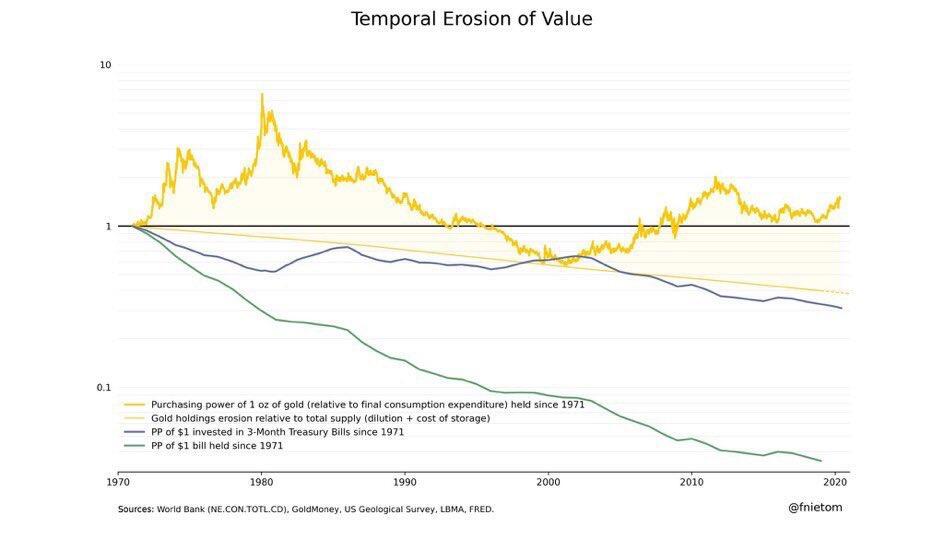

Precious metals have served as monetary backing for millennia, but this does not guarantee that gold is a safe investment or a good hedge against economic crises and monetary collapses. Since its last major rally in the 1980s, gold has been progressively demonetized.

Those who acquired gold in the late 1980s will need to rely on a significant increase in demand or a supply shock for its price to rise by 561% and regain the purchasing power it had 40 years ago.

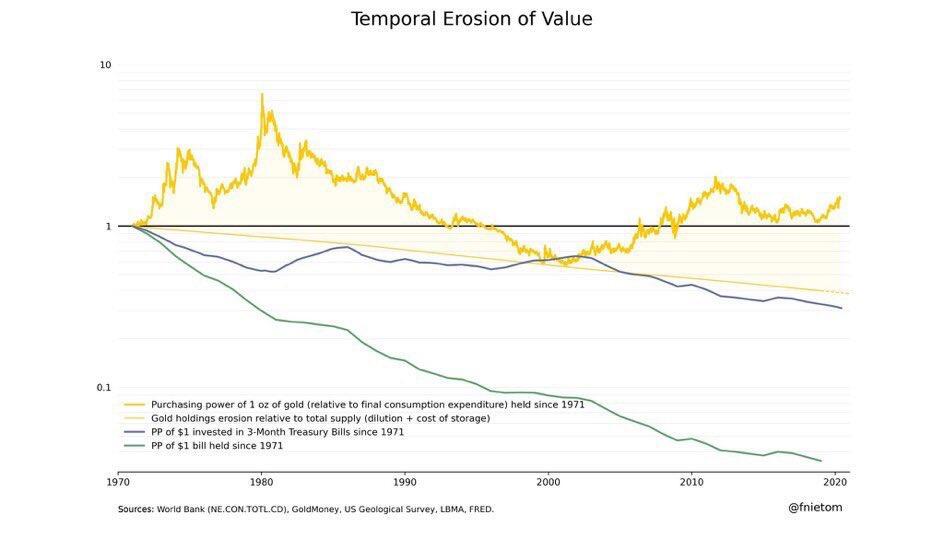

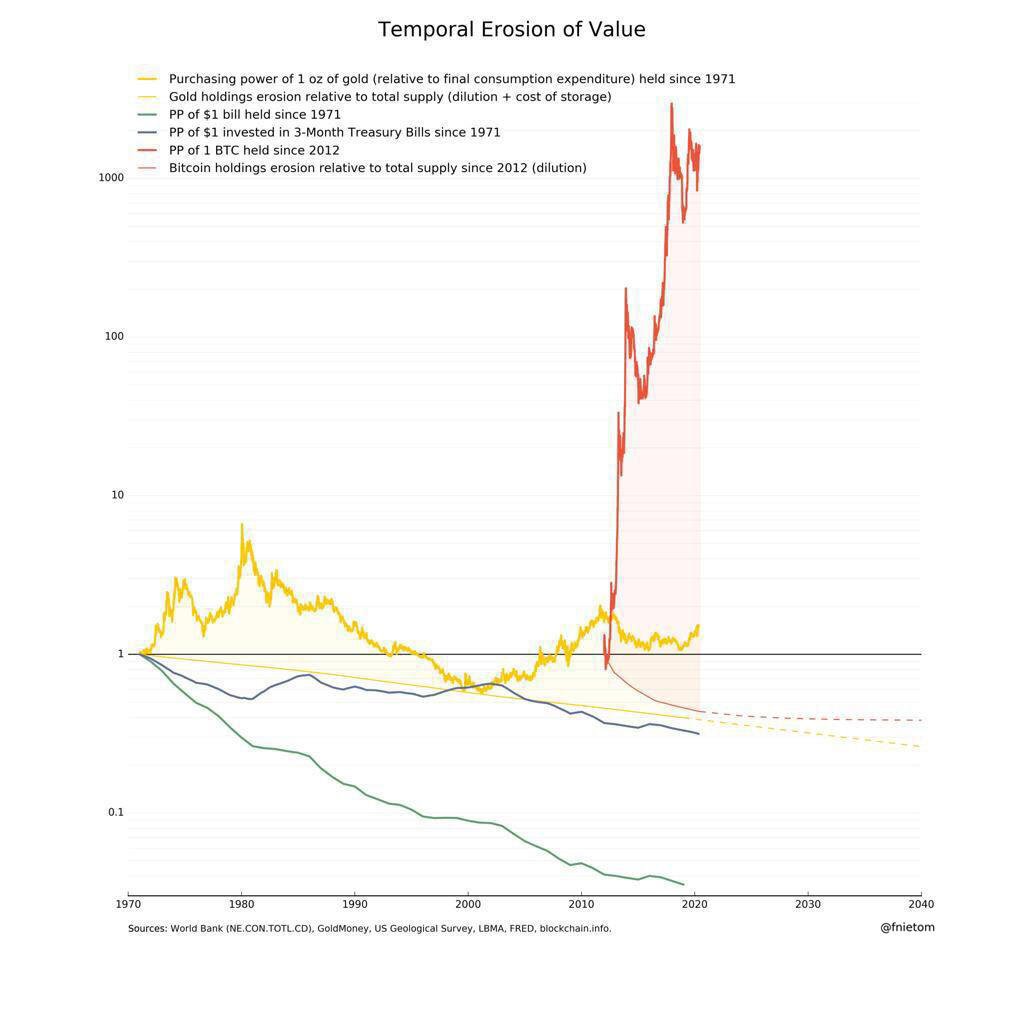

If you look at the purchasing power of $1 (green line), you'll see that the depreciation is even faster. This might create the impression that gold is a good store of value. But does the fact that something loses value more slowly amidst a general decline really make it a store of value?

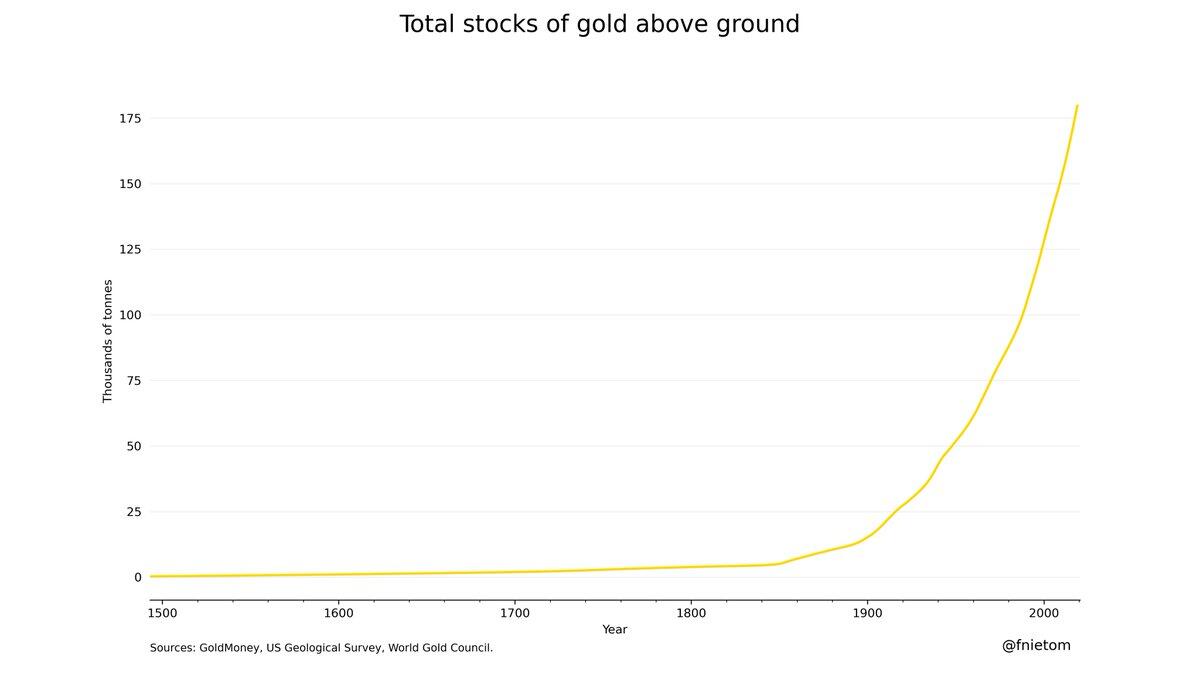

Unless the total demand for gold increases at the same rate as its supply has grown in recent years, the purchasing power of the metal is likely to decline.

In other words, if you own an ounce of gold, that ounce will represent an increasingly smaller fraction of the total gold reserves, meaning you are being diluted. Additionally, one should also consider the cost and risk of storage, but that's another issue.

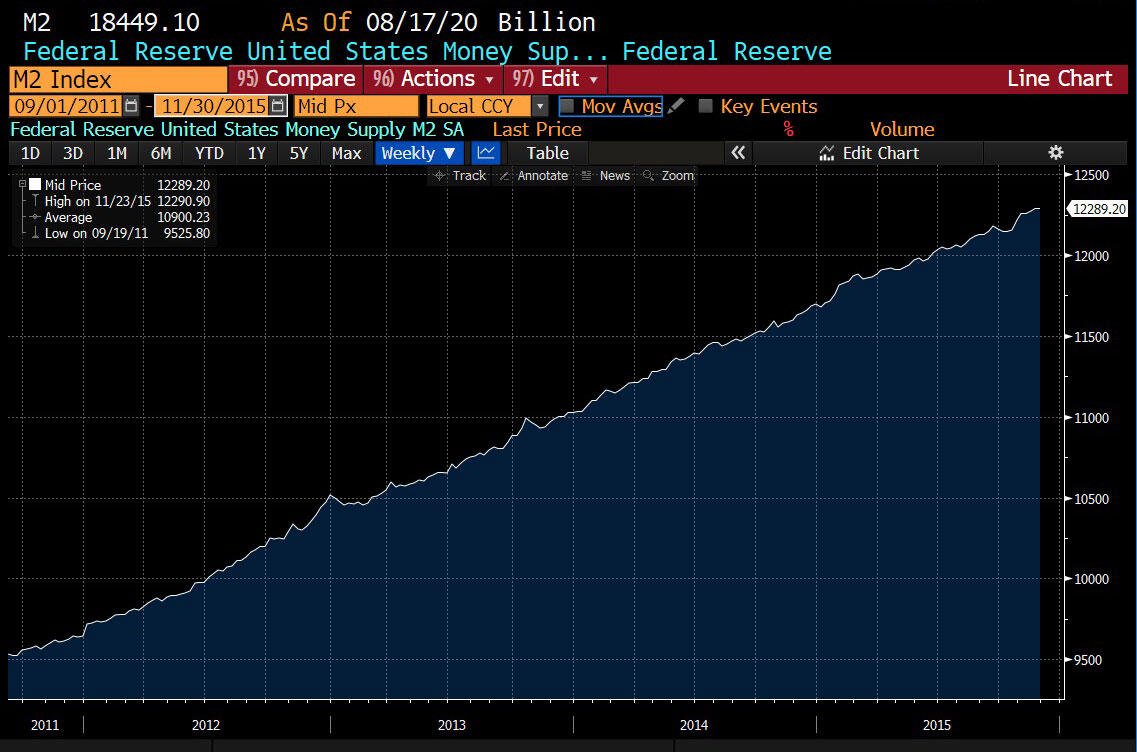

If you don't want to compare the purchasing power of gold today with the 1980s, you can consider its value from 9 years ago. Between September 2011 and November 2015, the Fed printed approximately $2.8 trillion. This also provides a perspective on gold's depreciation relative to the significant monetary expansion during that period.

In other words, the Fed expanded its monetary base by about 30% during that 4-year period. However, the price of an ounce of gold fell by 45% (from $1,900 to $1,057) over the same interval. A true store of value should protect against excessive money printing. In contrast, during that same period, Bitcoin appreciated by 8,500% (from $5 to $419).

Indeed, while it is interesting to note that this was the exact period when gold derivatives were launched on CME Group, it's important to remember that correlation does not imply causation. Many factors can influence the price of gold and Bitcoin, and establishing a direct causal relationship requires more detailed analysis.

In an asset where supply can only be physically verified, flooding the market with gold contracts could lead to significant issues. This might result in market manipulation, legal liabilities, fines, and potentially even imprisonment for those involved. Such actions can undermine the integrity of the market and lead to regulatory and legal consequences.

Over longer periods, gold has not functioned as a true "store of value" relative to the dollar for quite some time, despite recently returning to its price from 9 years ago. This suggests that, while gold may have periods of price recovery, it has struggled to maintain its value over extended horizons compared to fiat currencies.

It's worth noting that before 1980, aluminum was valued higher than gold. This reflects how market dynamics and technological advancements can significantly impact the value of commodities over time.

While gold has been undergoing a gradual demonetization process since 1980, another asset appears to be experiencing the opposite—hyper-monetization. (See in red; don't be alarmed.)

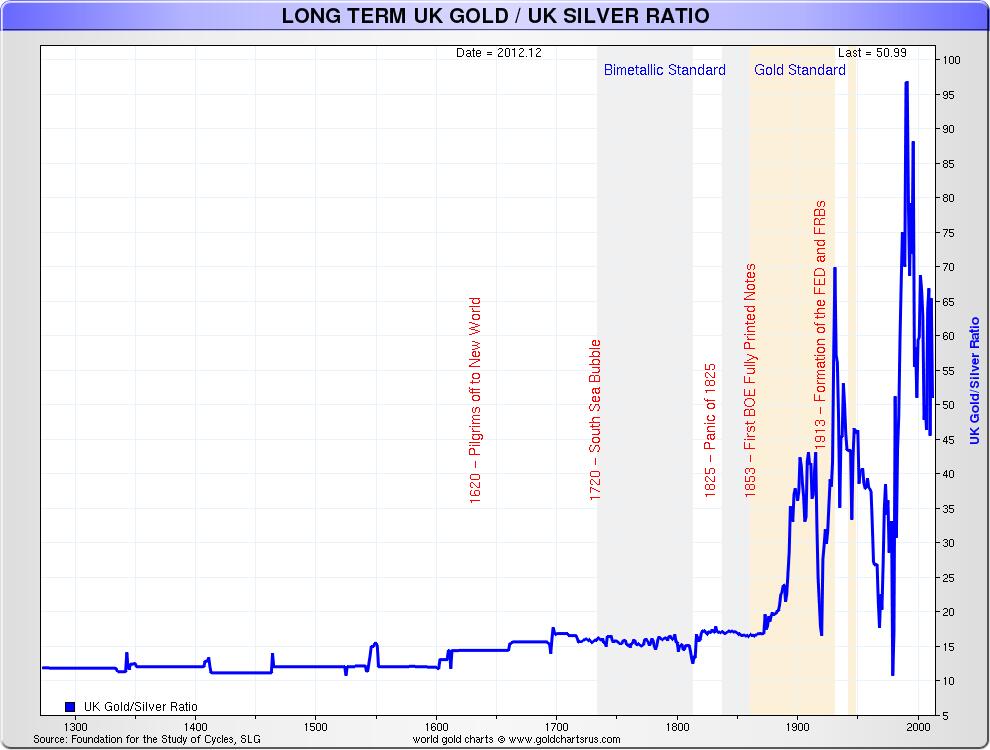

With the advent of Bitcoin, you believe that gold will continue on the same path as silver since the end of the bimetallic standard in 1853: a prolonged process of demonetization, with increasing volatility and reduced liquidity.

Since 1913, the dollar has lost 97% of its purchasing power. Over the same period, the gold supply has increased significantly. Since 1980, gold has lost about 82% of its purchasing power. Given that the dollar is used as the unit of account and gold's liquidity is measured in dollars, these changes reflect the complex interaction between the currency and the precious metal.

The U.S. is by far the country with the largest gold reserves in the world and is also the fourth-largest miner of the metal. Additionally, the country controls and issues the currency that serves as the unit of account for gold and has the highest liquidity in global trade.

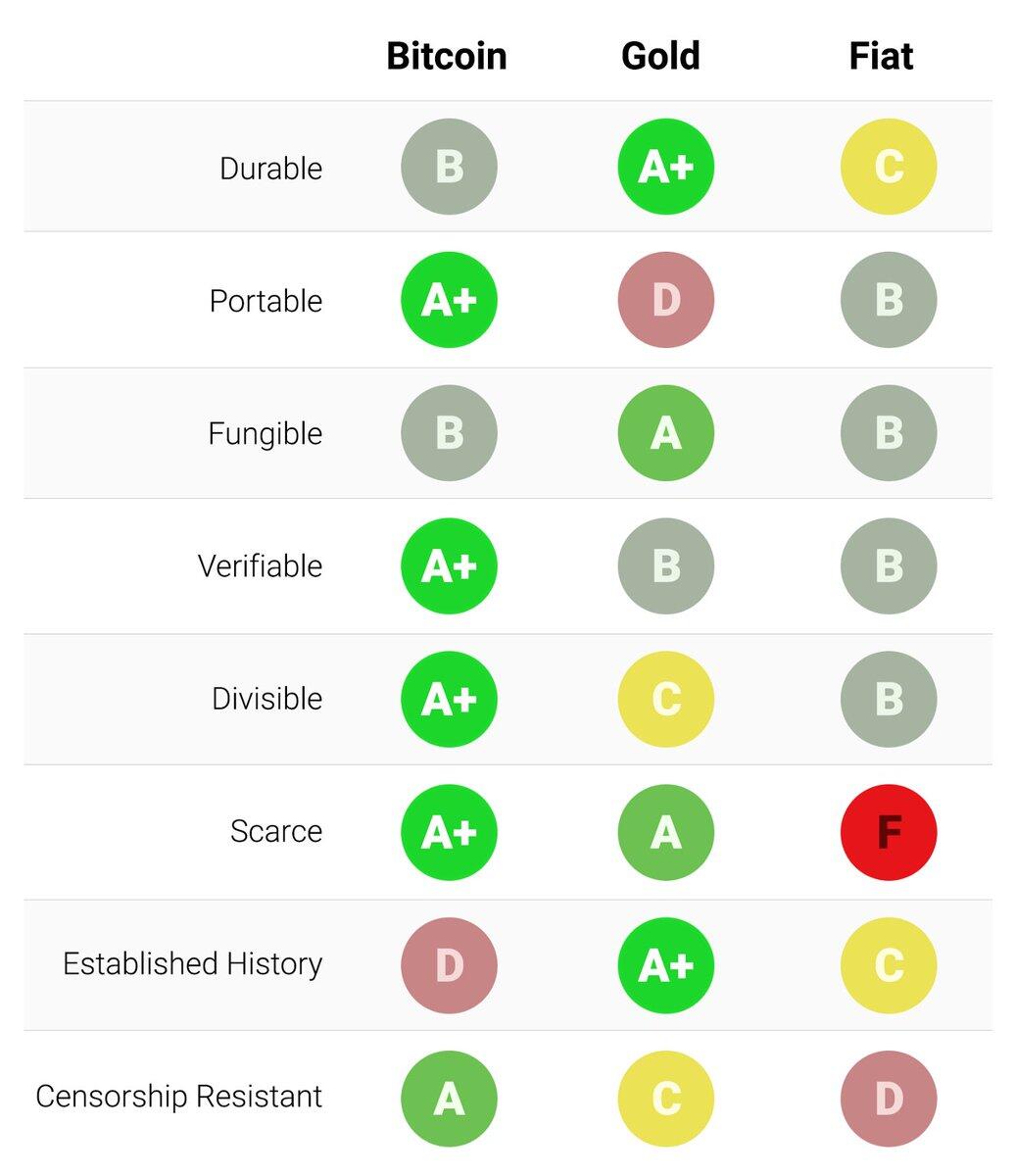

Is gold easy to transport? Is it simple to verify its supply and authenticity? Is it practical to store? Is its industrial utility significant? Can it be disrupted? And what about the continuous increase in its supply? These are important questions to consider.

In my humble opinion, it will not be the dollar or fiat currencies that will suffer the most from the existence of Bitcoin, but rather the market cap of gold.