The "supply shock" in the short term is actually an illusion.

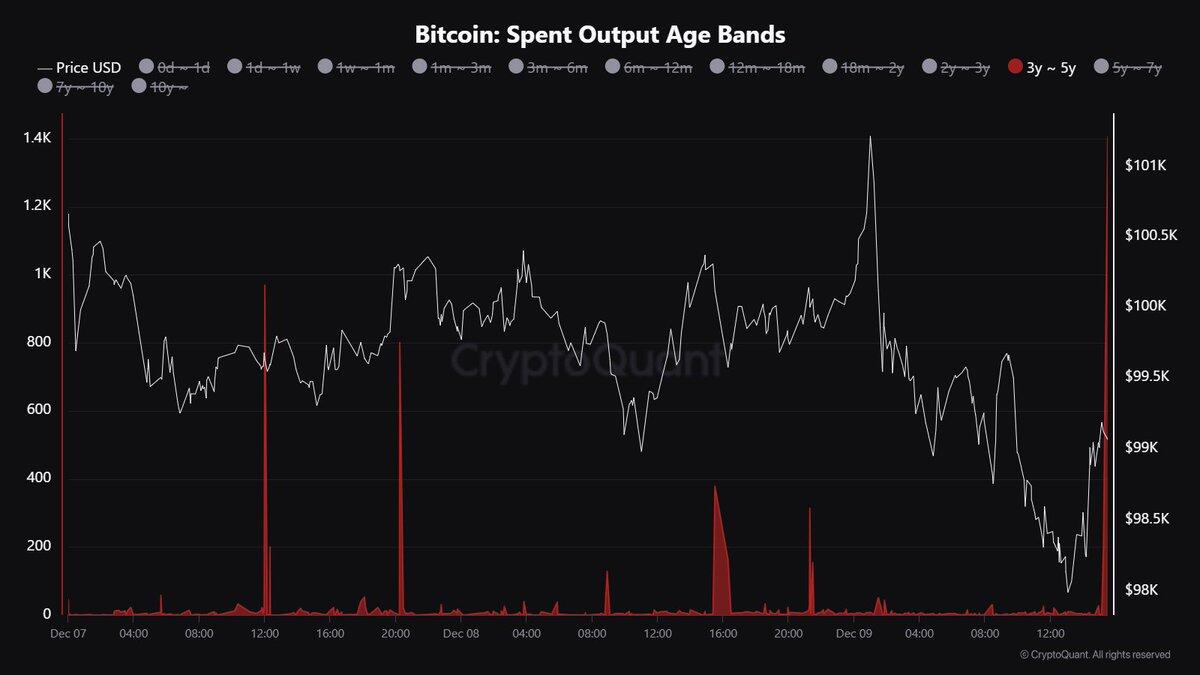

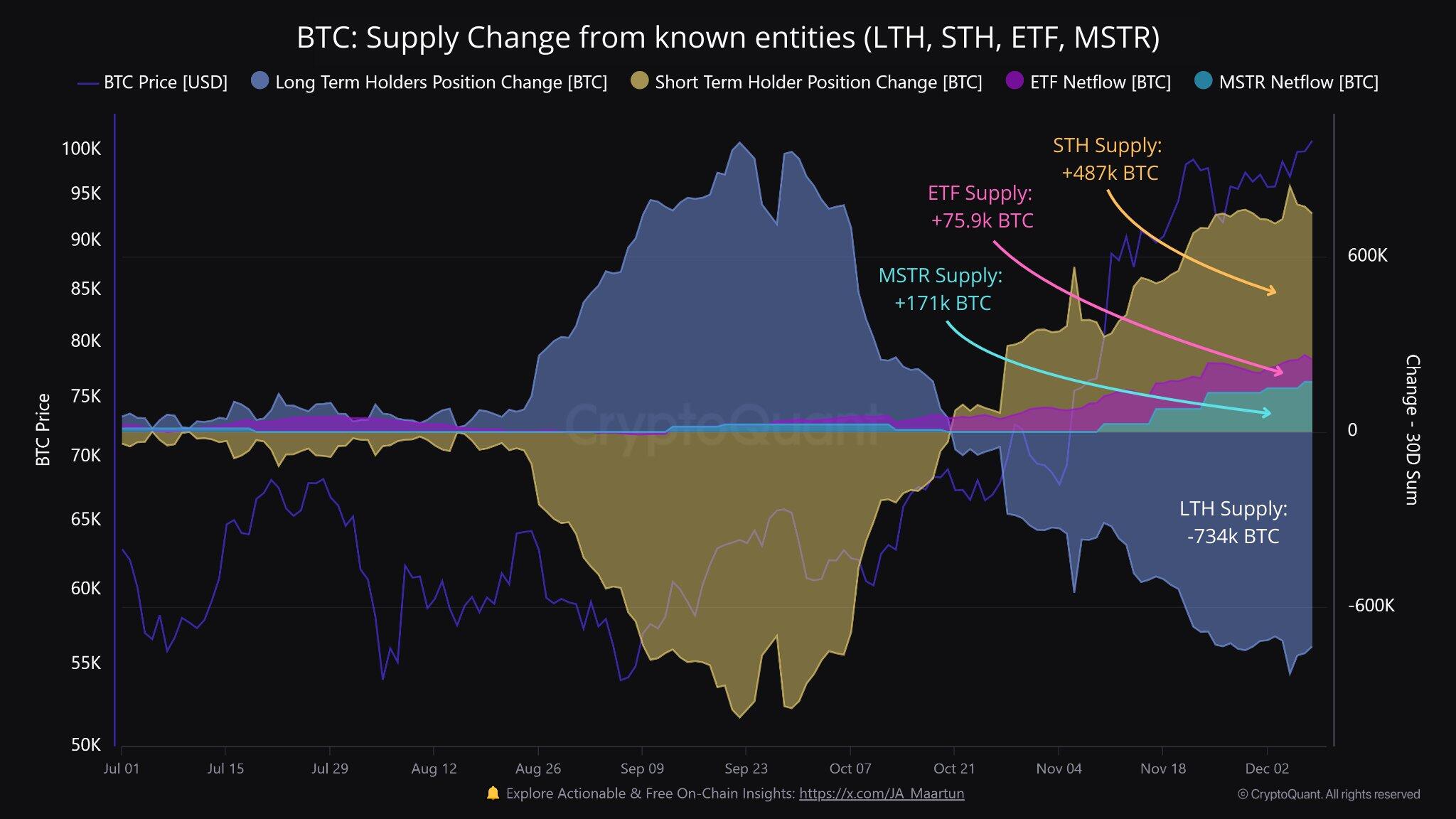

Currently, long-term holders are distributing the largest amount of BTC since 2021. In the last 30 days, participants from earlier in this cycle have sold over 640,000 Bitcoins, which have been proportionally acquired by short-term holders.

This process of hand-to-hand transfer results in waves of profit-taking, but these sales are absorbed by new participants in the network. The idea that buyers will accumulate Bitcoin and never spend it again clashes with the reality of profit-taking.

While the supply shock is real in the long term, due to the reduction in network inflation (currently 0.8% per year) and the loss of coins, in the short term, this doesn’t materialize.

Today, despite the decline in exchange reserves, anyone interested in buying can still do so. When the time comes when buying is no longer possible, that's when we'll start talking about the supply shock. Will it happen tomorrow? In 10 years? We don't know.

In the meantime, take advantage of the fact that there are still coins available.