The Greatest Crime in Human History

Few people are aware, but there is a monumental crime spanning generations, involving powerful families that control the global financial system. This crime not only shaped the world as we know it but also stole something essential from humanity: real money. In its place, they gave us fake money. Here's how it happened, step by step.

Real Money: Gold and Silver

Since the dawn of free trade, gold and silver emerged as natural money. Their exceptional properties—durability, divisibility, portability, and scarcity—made them the preferred currencies in market competition throughout history.

Free Banking: Banks in a Free Market

Practical challenges with gold, such as transportation, purity verification, and divisibility, were resolved by banks operating in a free-market system. These banks safeguarded gold in custody and issued their own notes representing stored value. This enhanced trade efficiency without compromising the foundation of real money.

1913: The Creation of the FED

Everything changed with the establishment of the Federal Reserve (FED), a central bank controlled by an oligopoly of bankers. This system centralized gold control, forcing banks to surrender their reserves to the U.S. Treasury, which issued gold certificates to the FED. This marked the first step in the capture of real money.

1933: Gold Confiscation in the U.S.

Through a controversial law, the U.S. government banned citizens from owning gold, threatening fines and imprisonment for non-compliance. All confiscated gold was transferred to Fort Knox, consolidating the FED's absolute control over real money.

1944: Bretton Woods

The Bretton Woods system established the U.S. dollar, backed by gold, as the global reserve currency. Other countries began using dollars instead of gold as monetary reserves, leading to a massive concentration of gold in the United States.

1971: Nixon’s “Default”

With the U.S. printing more dollars than its gold reserves could cover, President Richard Nixon unilaterally ended the dollar’s convertibility into gold. From that moment on, all currencies became debt-based. The capture of real money was complete.

1973: The Petrodollar

To sustain demand for the now-fiat dollar, the U.S. struck deals with OPEC, ensuring that oil would be traded exclusively in dollars. This maneuver linked the dollar to energy, securing its global dominance despite lacking real backing.

Fake Money and Repeated Crises

With the collapse of the gold standard, instability became the norm. Since then, we’ve faced recurring crises:

- 1979: Oil crisis.

- 1982: Latin American debt crisis.

- 1987: Black Monday.

- 1990-91: Economic recession.

- 2000-02: Dot-com bubble burst.

- 2007-09: Great Recession.

- 2020: COVID-19 crisis.

Each crisis resulted in more money printed by central banks, worsening inequality even further.

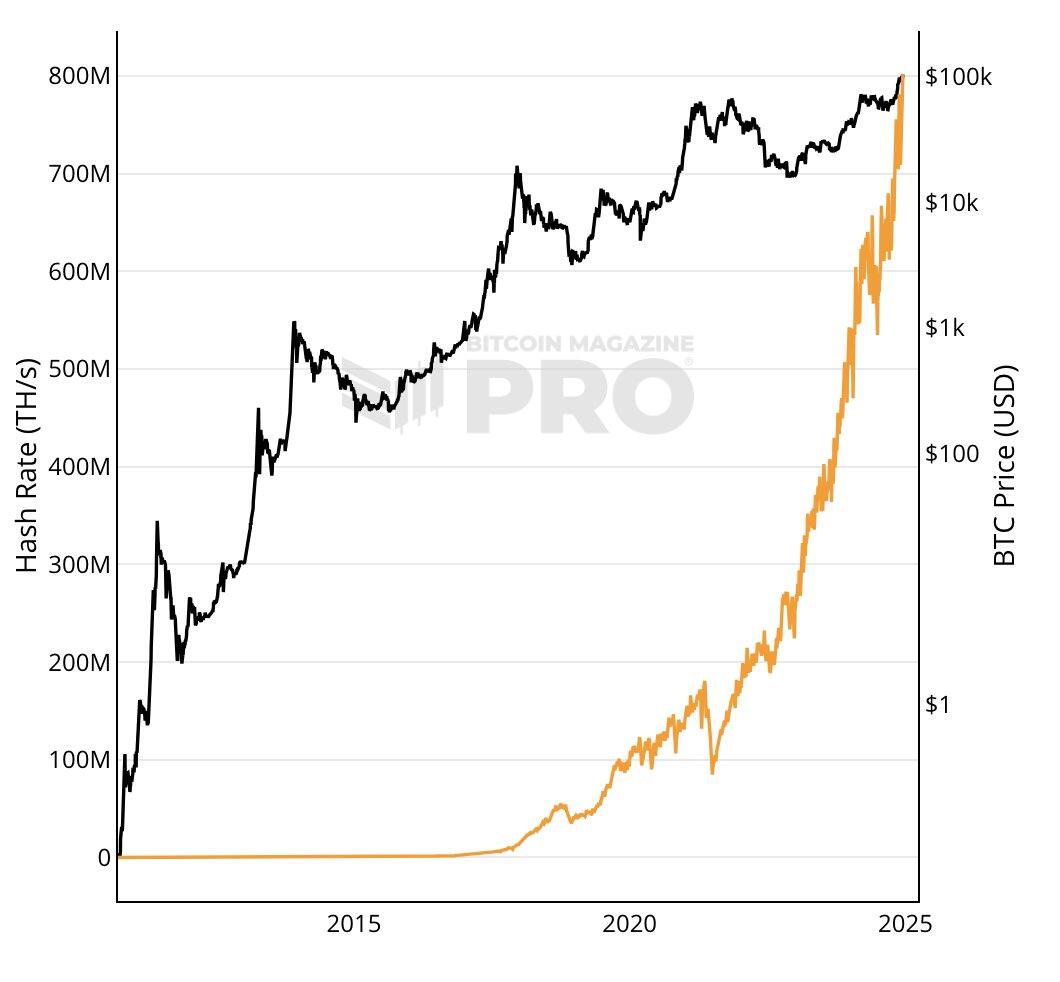

2008: The Birth of Bitcoin

Bitcoin emerged as a response to this corrupt system. It is decentralized, unconfiscatable, and limited, offering an alternative to the fake money imposed by central banks. For the first time since 1933, we have the chance to use real, sound money again.

2020: Lockdowns and Infinite Money

During the pandemic, central banks printed trillions of dollars to fund “relief” packages. In reality, this policy accelerated the breakdown of the financial system, the consequences of which we are experiencing today in 2023.

2023: The Rise of CBDCs

With the economy collapsing, governments presented Central Bank Digital Currencies (CBDCs) as the solution. These digital currencies offer an unprecedented level of monetary surveillance and control, enslaving populations in ways never seen before.

The Consequences of Fake Money

Since 1971, fiat money has caused:

- Rising income inequality.

- Constant inflation.

- Corruption of moral values.

- Growing debt.

- Unaffordable housing prices.

- Periodic financial crises.

All of this enriched financial elites while the working population bore the cost.

Bitcoin: Our Only Hope

Bitcoin offers humanity the only opportunity to return to natural money, protected from capture. Fully respecting property rights and resistant to manipulation, adopting it is a moral imperative.

With Bitcoin, we can dream of a future where:

- Economic freedom is guaranteed.

- Financial inclusion becomes a reality for everyone.

- Individual autonomy triumphs over centralizing elites.

Adopting Bitcoin is a crucial step toward rebuilding a fairer, more prosperous world free from arbitrary monetary policies.

Join this revolution and reclaim control over money and the future of humanity.