BITCOIN IS SWALLOWING THE CURRENT MONETARY SYSTEM, AND I CAN PROVE IT

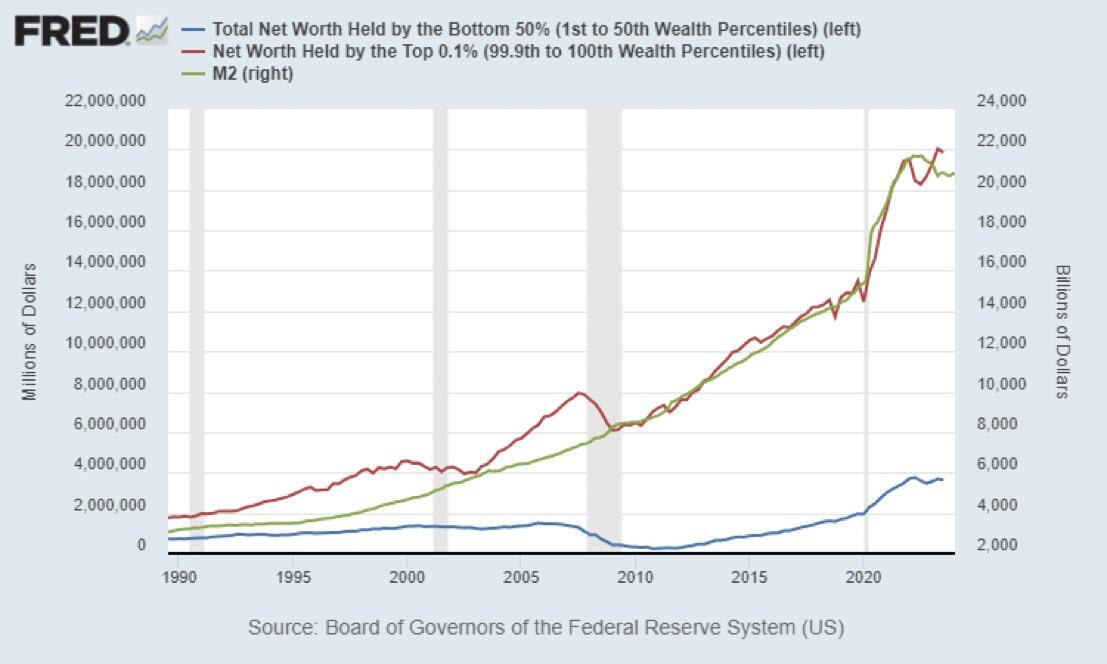

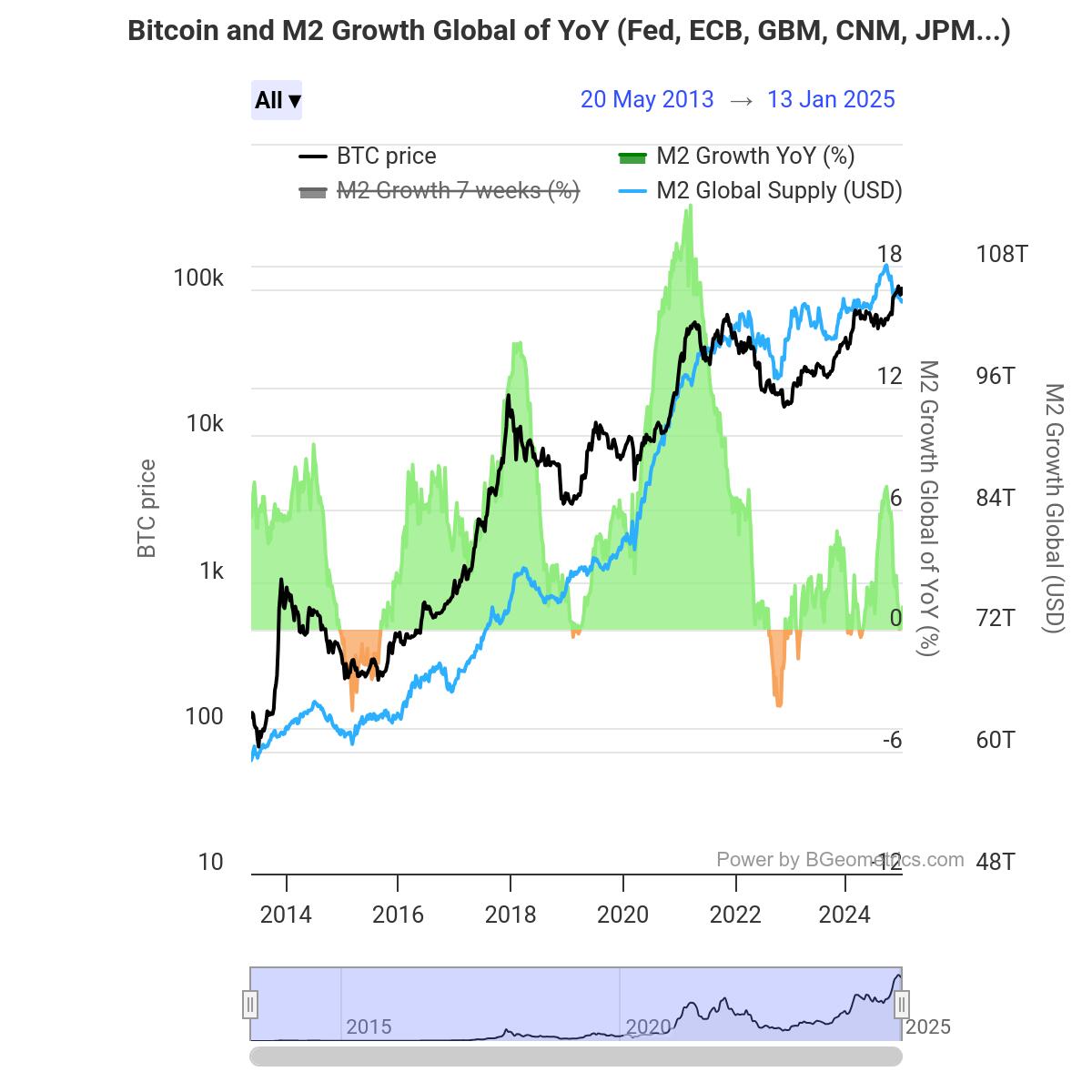

One way to track the pattern of unchecked debt issuance is by observing the growth of money in circulation globally.

For this, we can use the M2 of the world’s largest central banks to monitor this trend.

Currently, this monetary aggregate stands at around $105 trillion and is still growing.

Naturally, many might ask: is the rise of Bitcoin just a reflection of the increasing monetary base, without real gains?

The answer is a mix of yes and no, because indeed there were periods where we saw more nominal effects than real ones. For example, between 2020 and 2021.

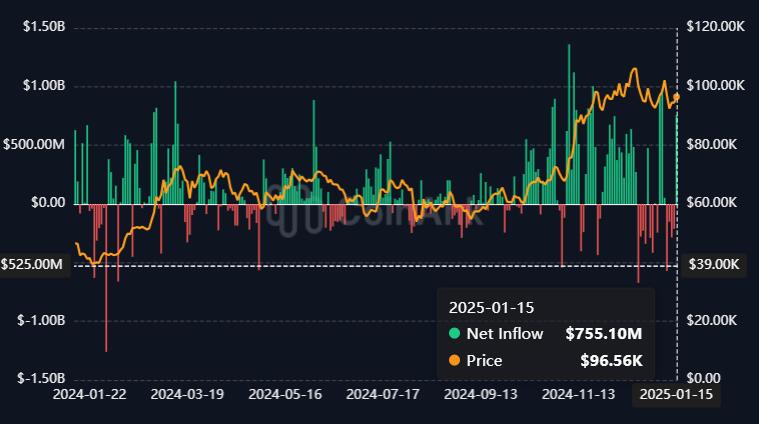

However, in the most recent cycle, Bitcoin’s market capitalization growth is much more related to institutional capital allocation and adoption as a financial asset than to nominal growth.

In 2020, Bitcoin’s market value represented just 0.13% of the money supply at that time, whereas today it represents 1.87%.

This means that in real terms, Bitcoin has grown about 1500%.

If you look at the price growth, you’ll see that it’s increased around 1800%.

During the same period, the monetary base grew by about 32%.

Therefore, the majority of Bitcoin’s growth has indeed been in real terms, driven by growing institutional adoption and interest, and not merely a reflection of the increase in the monetary base.