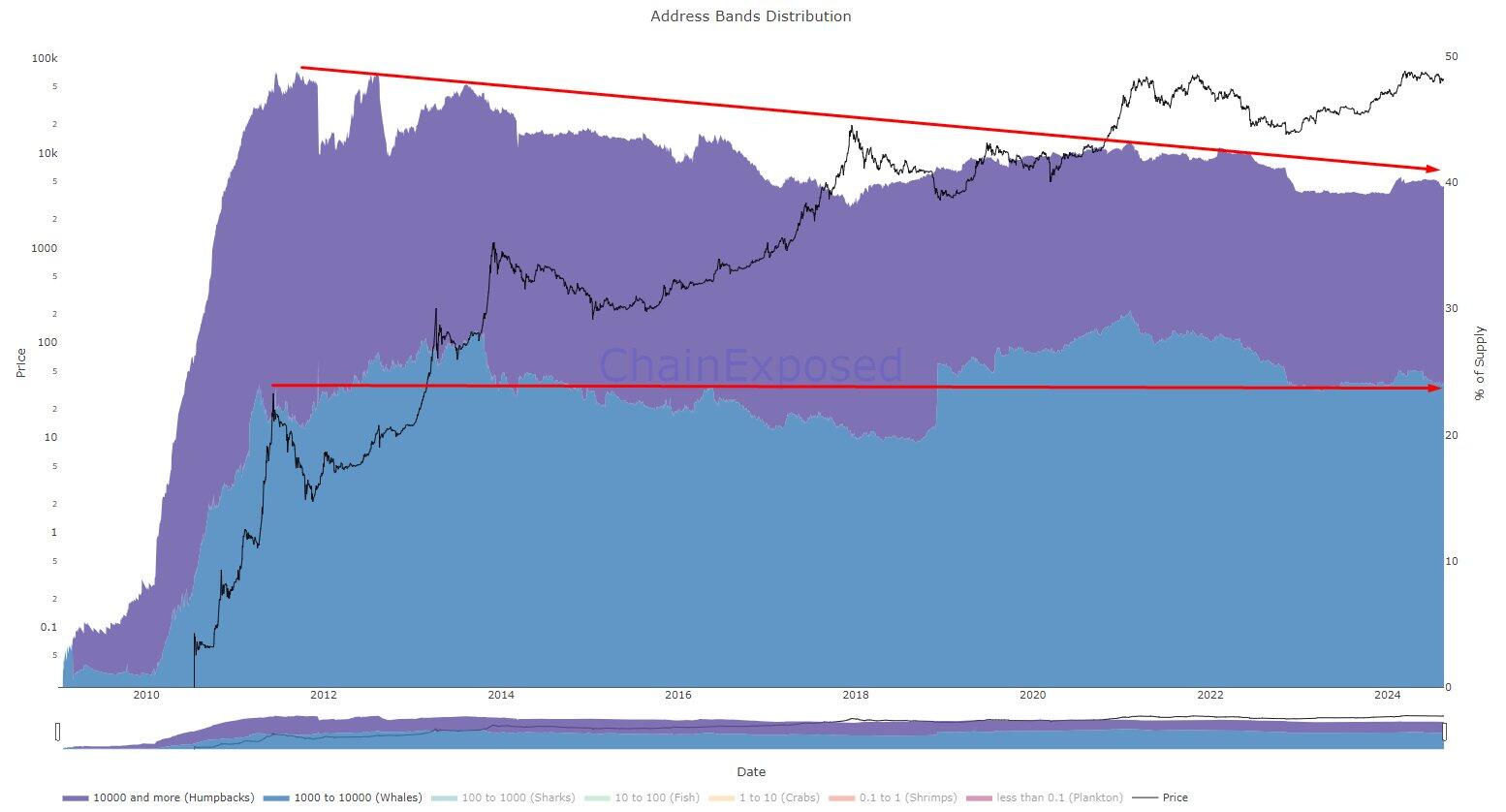

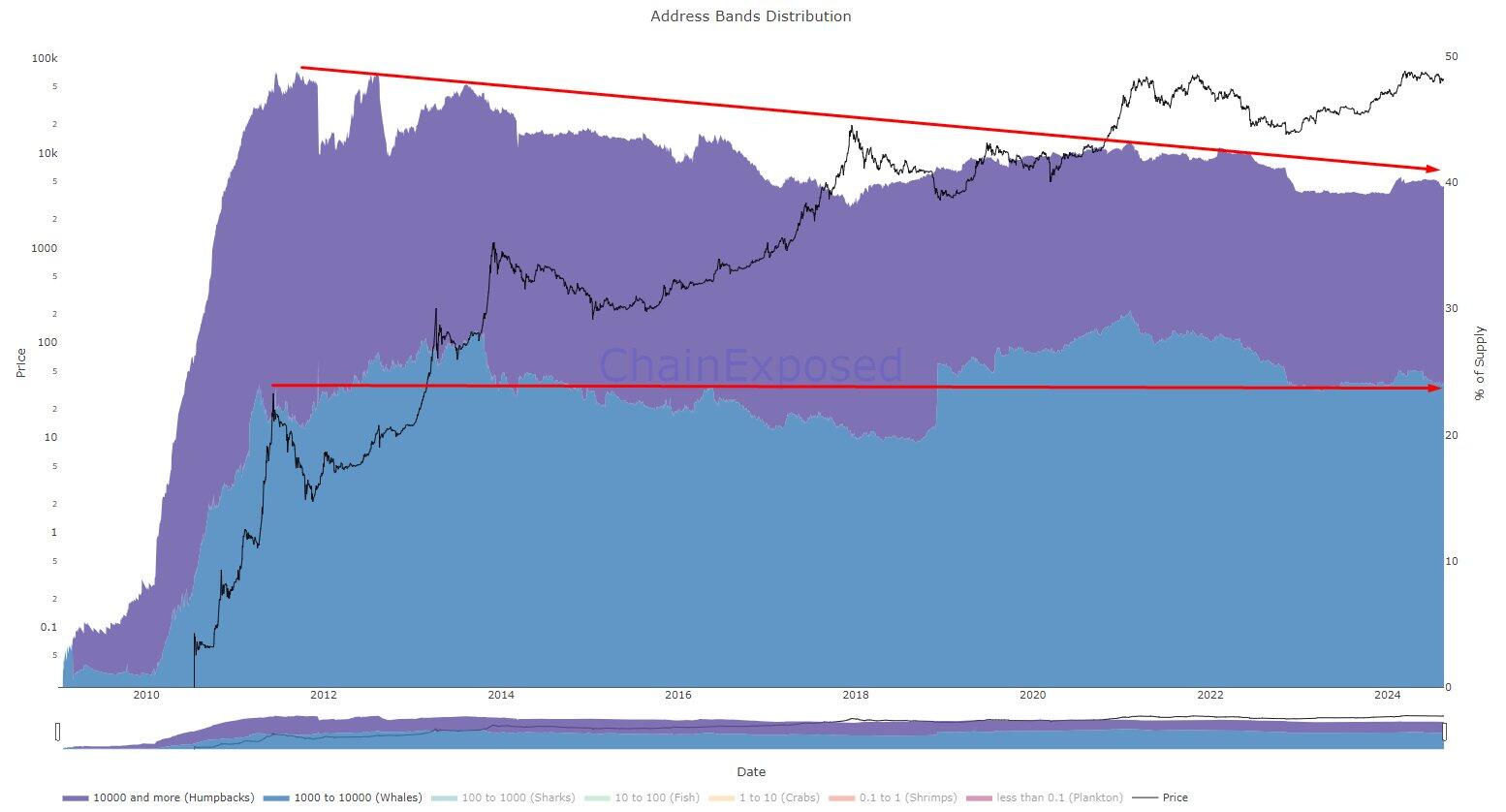

I frequently see people discussing institutional entry into Bitcoin as leading to greater coin centralization, but rarely does anyone provide data.

The argument for coin centralization is generally made by those who haven't looked into the current distribution of coins in Bitcoin.

If I asked you: in Bitcoin's history, are whales increasing or decreasing, what would you say?

If you answered that they're increasing, you're wrong.

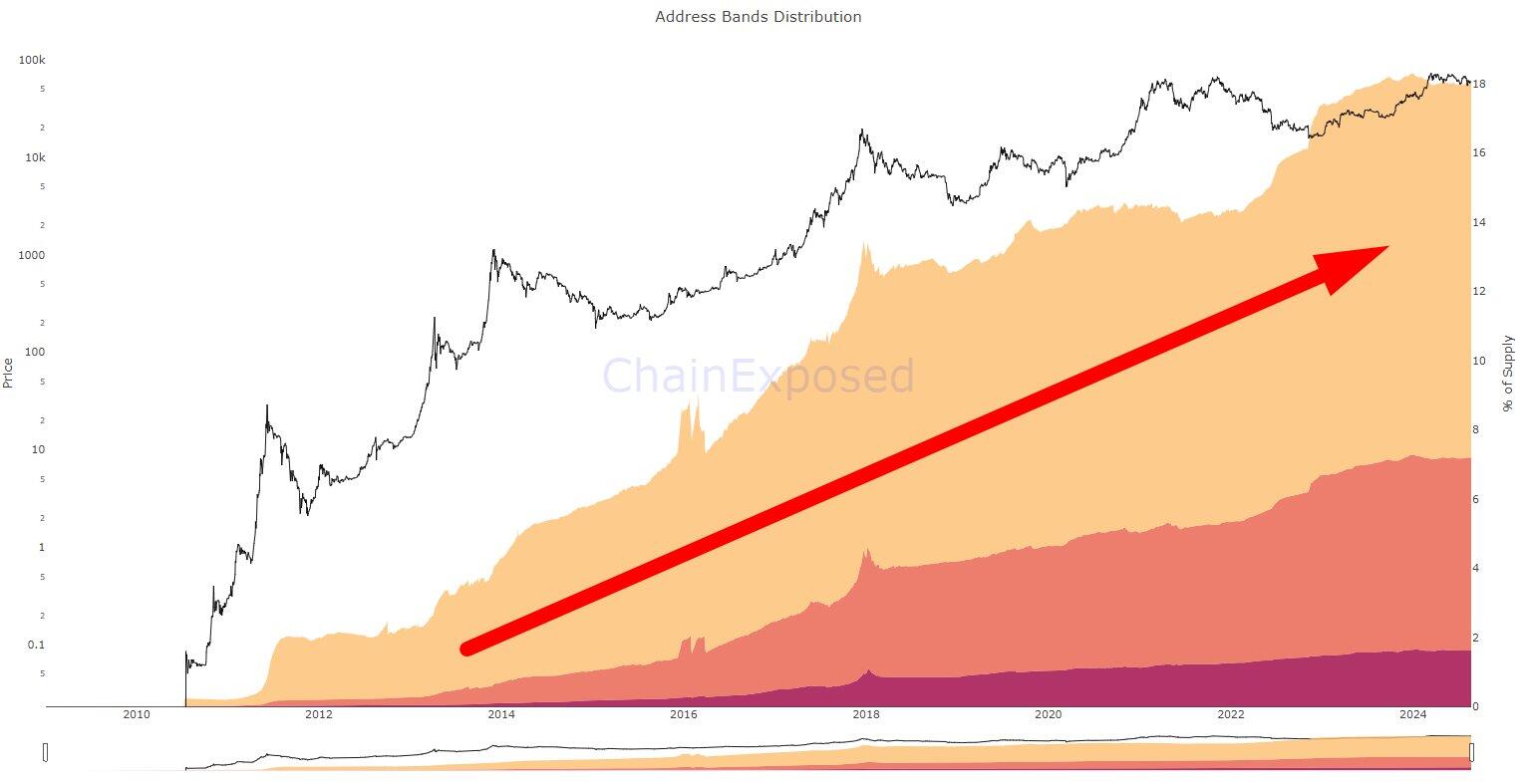

When we look at the percentage distribution of on-chain address reserves, we see that addresses with more than 10k BTC have decreased from 28% of the supply to 15% since the first cycle.

Additionally, addresses holding between 1k and 10k BTC (Whales) have maintained almost the same market share since 2011, yes, SINCE TWO THOUSAND AND ELEVEN.

Now, do you know an interesting fact?

The market share of regular individuals, holding less than 10 BTC, has only increased since 2011. Although they currently account for around 18% of the network, this number continues to rise.

This talk about coin centralization in Bitcoin (even if it represented something valid) is a fallacy.

When you hear a hater claiming that Bitcoin has "become more centralized," citing the number of participants with an abundance of coins, ask them to show you data confirming that.

They probably won't know what to do.